Best Practices in Teacher Pay: Teacher Benefits Overview & Spotlight on Healthcare Benefits

A comprehensive, professional compensation plan includes layered pay strategies that build on one another to ensure the recruitment and retention of a high-quality workforce. This is the tenth in a series of blogs highlighting best practices in teacher pay featured in detail in BEST NC’s report, Teacher Pay in North Carolina: A Smart Investment in Student Achievement.

Teacher Benefits Overview

Teacher retirement and healthcare benefits costs have risen sharply in the past two decades and require increasing levels of investment from states in order to maintain benefits levels and to fully fund pension obligations. As the costs of these benefits rise, state funding that could otherwise be used to increase teacher pay is diverted.

Chad Aldeman, policy director of Georgetown’s Edunomics Lab, notes that, after adjusting for inflation and rising student enrollment, total education spending in the United States increased by 29% from 1995 to 2015. Yet, despite this increase in education spending, inflation-adjusted teacher salaries actually decreased during this period. Aldeman attributes the stagnant teacher earnings amidst increased education spending to three factors: decreasing student-to-staff ratios, rising healthcare costs, and rising retirement costs.

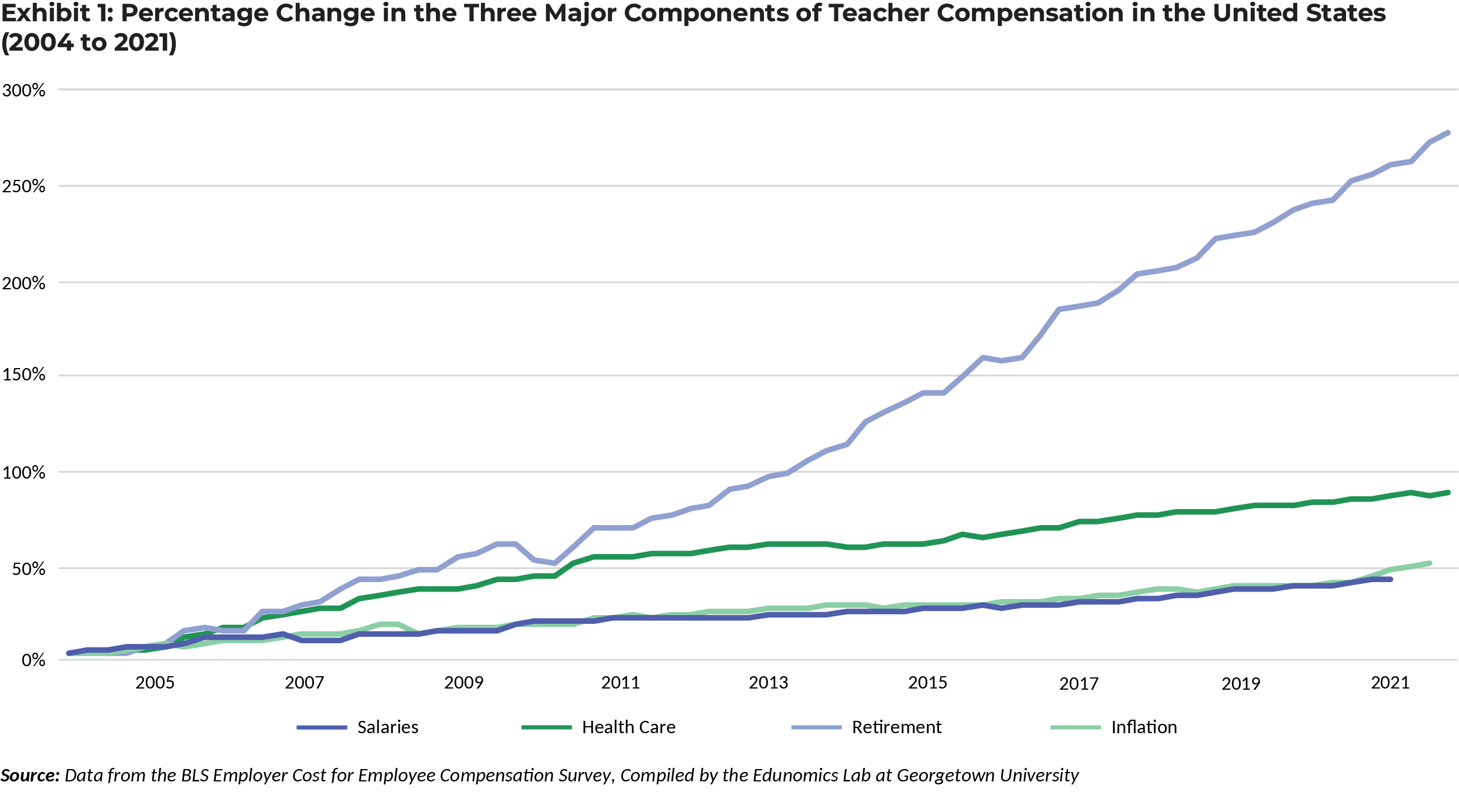

Exhibit 1 below illustrates the percentage change in the major components of teacher compensation compared to inflation. Between 2004 and 2021, teacher salaries roughly kept up with inflation, while healthcare costs, and especially retirement costs, significantly outpaced inflation. With more money paying for healthcare and the pensions of retired teachers, less is left over to support salary increases for teachers currently working in schools.

In 2021-22, 28% of North Carolina teachers’ total compensation was in the form of benefits, compared to 17% in the private sector in the South Atlantic region. At this level, for every dollar spent on teacher salaries, nearly 40 cents must be spent on pensions and benefits. In other words, a $100 million investment in teacher pay actually costs the state $140 million.

Healthcare Benefits

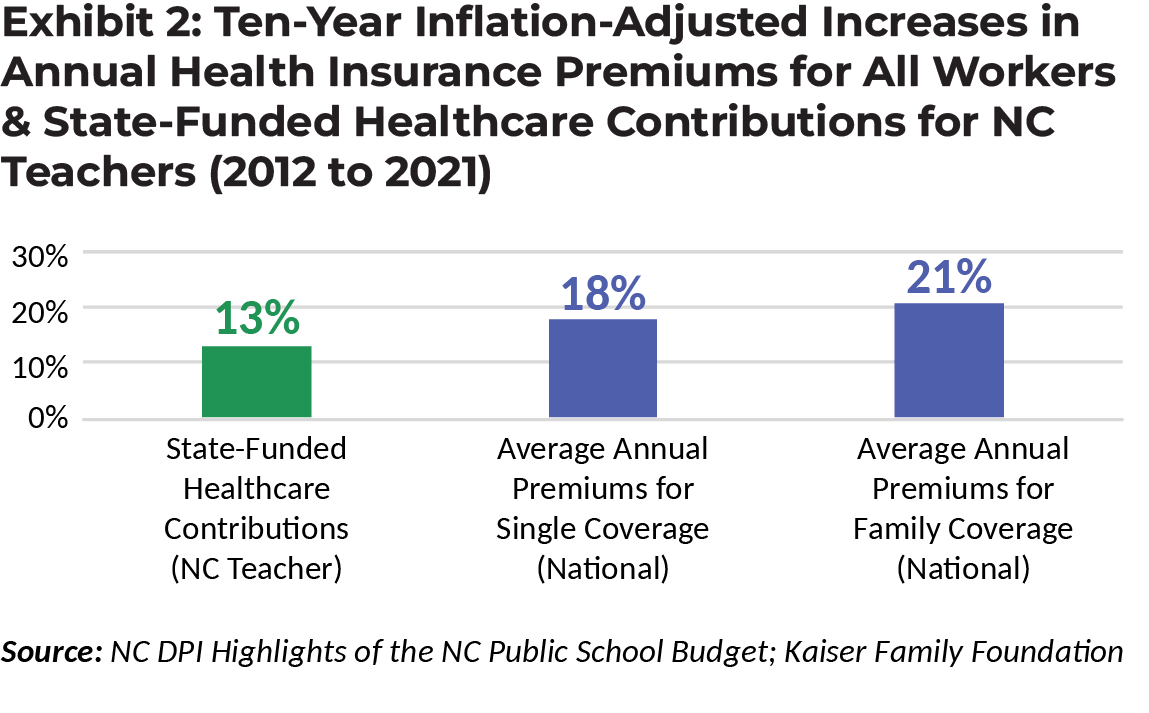

Nationally, increases in health insurance premiums for all workers have outpaced increases in earnings for several decades. Since 2012, increases in health insurance premiums for single coverage have increased 18% after adjusting for inflation, while family coverage premiums have increased 21%. Unsurprisingly, as the costs of health insurance have gone up across the country, North Carolina’s contributions to teacher health insurance costs have increased by 13% (see Exhibit 2 above).

Across the country, school districts pay a higher percentage of teacher health insurance premiums than do private employers. In an NCTQ study of 124 of the nation’s largest school districts, districts covered an average of 92% of health insurance premiums on individual plans, compared with 78% in the private sector. For family plans, the percentages are 79% and 67%, respectively.

Given the rapidly increasing cost of health insurance and the fact that school districts tend to pay larger shares of health insurance premiums, rising healthcare costs increasingly compete with efforts to raise teacher salaries in North Carolina and across the country.