Best Practices in Teacher Pay: Spotlight on Teacher Retirement Benefits

A comprehensive, professional compensation plan includes layered pay strategies that build on one another to ensure the recruitment and retention of a high-quality workforce. This is the eleventh in a series of blogs highlighting best practices in teacher pay featured in detail in BEST NC’s report, Teacher Pay in North Carolina: A Smart Investment in Student Achievement.

The previous blog in our teacher pay provides an overview of trends in teacher health care and retirement benefits and delves into how health care benefits for North Carolina teachers have changed over the past 10 years. This blog examines teacher retirement benefits, both nationally and in North Carolina.

Retirement Benefits

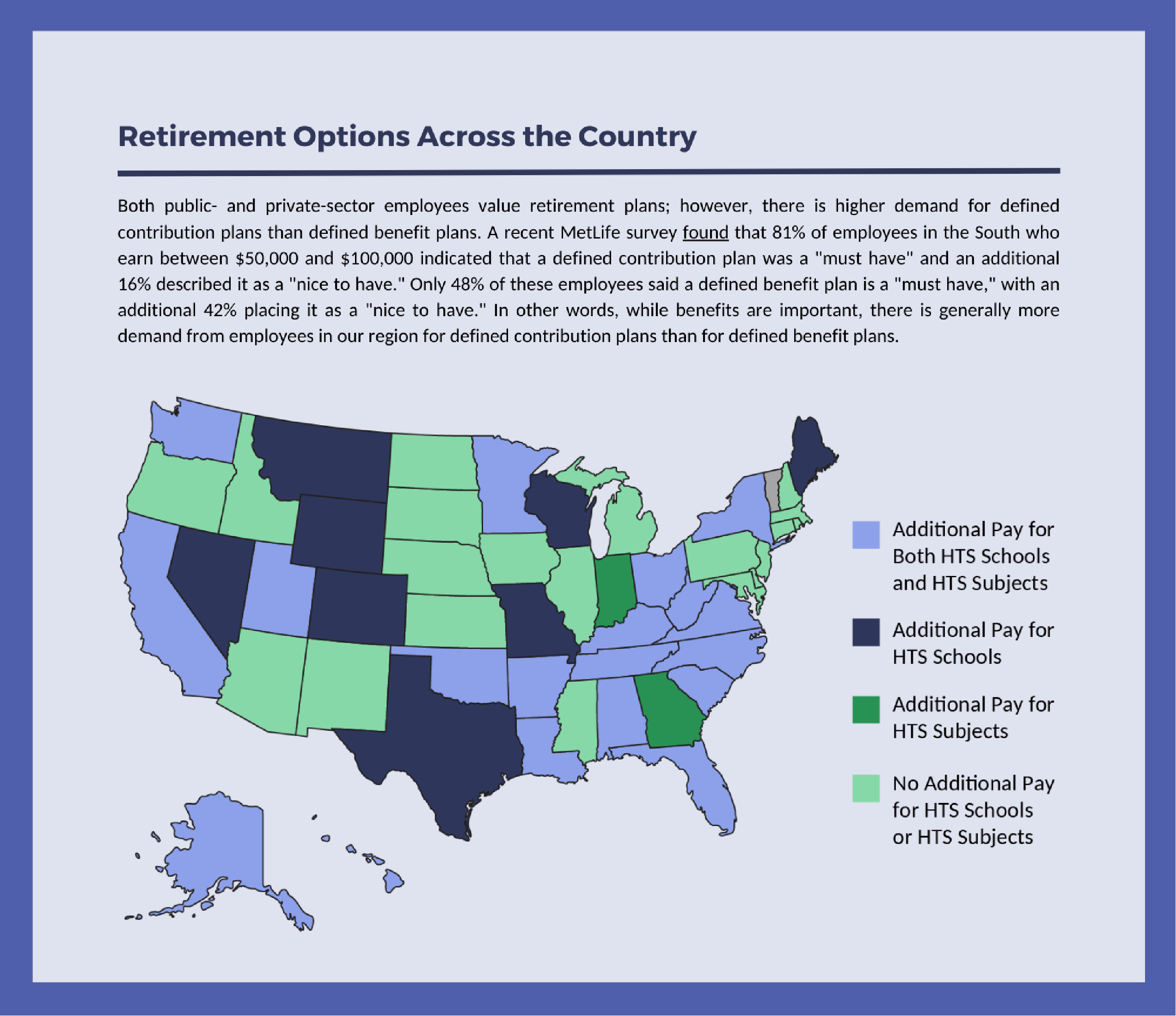

Nationally, 90% of all public school teachers are enrolled in defined retirement benefit plans, wherein retirees are paid a guaranteed pension benefit based upon a predefined formula, often based on variables like years of experience and highest salary level. In 2021-22, 36 states used a defined benefit plan as their default option, including North Carolina. Other retirement options offered by states include:

- Direct contribution plans, in which teachers and employers each contribute a percentage of a teacher’s salary into an individual account and the funds are invested. The value of the account fluctuates depending upon the performance of the underlying investments.

- Cash balance plans, in which teachers contribute a percent of their salary to retirement. The state manages the funds and guarantees a certain rate of annual interest, with higher rates of guaranteed interest for longer-tenured teachers.

- Hybrid plans, which incorporate features from defined benefit and defined contribution plans.

In most states that use defined benefit pension plans, pension formulas consider the retiree’s years of experience and highest salary level (often an average over a series of years). In North Carolina, teachers are eligible to begin collecting pension payments at 30 years of experience, regardless of age; at 25 years of experience, if age 60 or older; or at 5 years of experience, if age 65 or older.

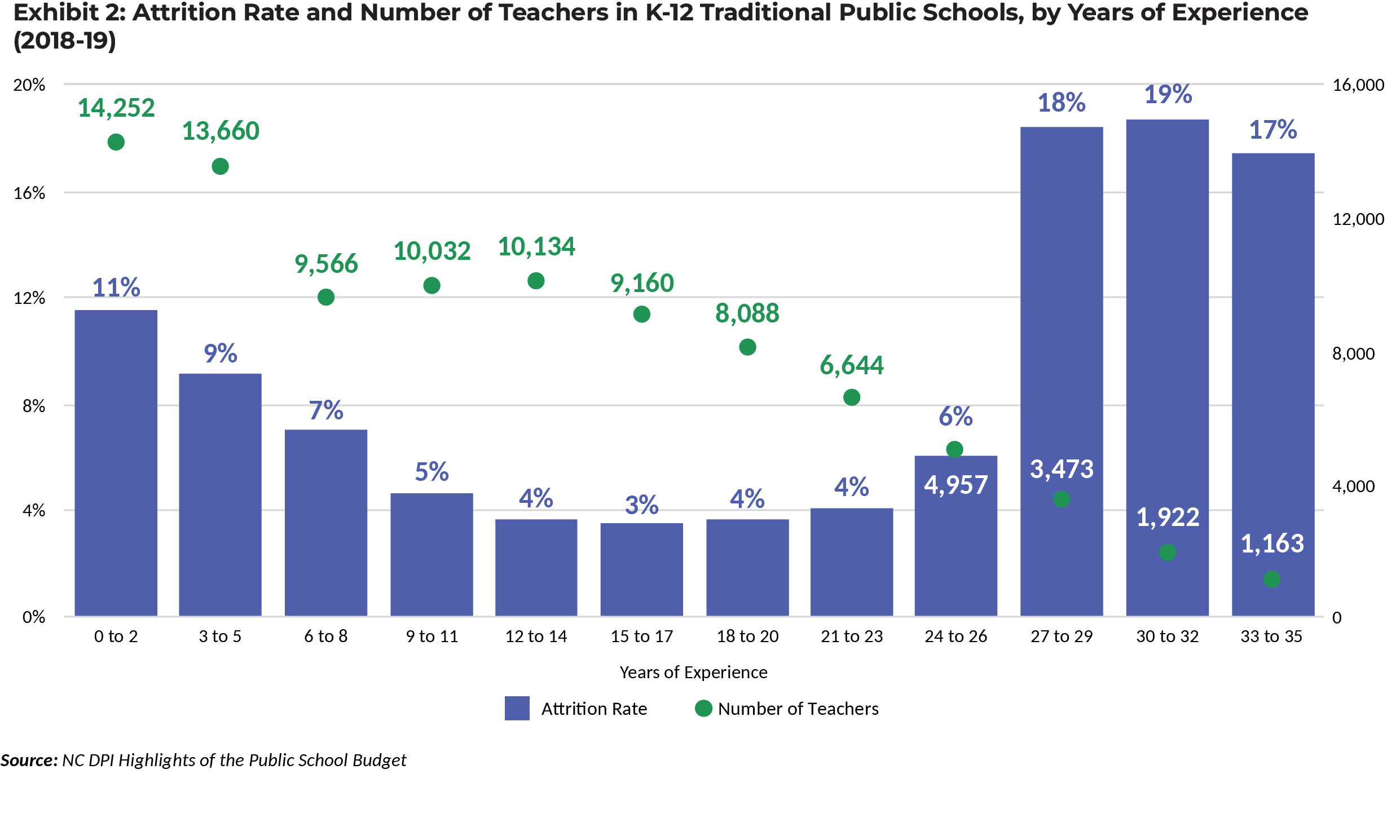

Since most teacher salary schedules require decades of experience before reaching the highest salary bands, the longest-tenured teachers receive a much better return on their pension contributions than teachers who work for a lesser number of years.

Source: MetLife

.

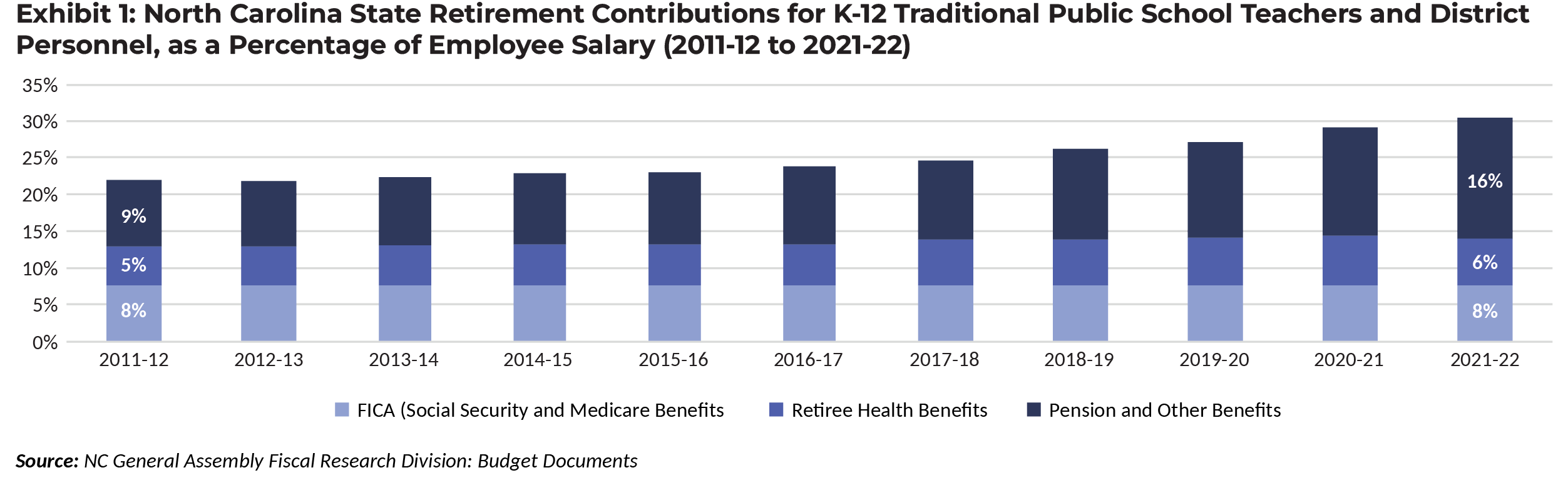

In the defined benefit plans offered by most states, the retirement benefits drawn down by teachers are not tied to teachers’ contributions to the system. The result is that, while employer contributions to teacher retirement plans continue to increase, the majority of those contributions are going to pay down existing pension obligations, and states are cutting benefits in order to make pension plans more sustainable.

This certainly holds true in North Carolina, where 65% of employer pension contributions for teachers working in North Carolina’s schools go to paying down existing obligations to current retirees, with just 35% going to active teachers’ future retirement benefits. At the same time, retirement contributions as a percentage of teacher salary have increased from 9% to 16% since 2012, mainly due to the state’s efforts to keep pace with its ongoing teacher pension plan obligations:

Conventional thinking suggests that teachers – and public employees more generally – enter the profession knowing that they will accept lower salaries in exchange for increased benefits. However, pensions represent a significant portion of all benefits and the greatest pension benefits accrue to the small subset of teachers who stay in the profession long enough to retire. In fact, research finds that about half of all new teachers leave the profession without qualifying for a pension benefit at all, despite having contributed to the retirement system.

Additionally, under the existing system, retirement eligibility criteria act to incentivize retention for teachers between 15 and 25 years of teaching (those teachers who are on track to collect the largest pension benefits) and incentivize retirement for teachers between 25 and 30 years into their career (when most career teachers are first eligible to receive pension payments). This can be visualized by examining the number of state-funded teachers in North Carolina, sorted by years of experience, and noticing the dramatic increase in attrition at 27 to 29 years of experience:

Perceptions of Retirement Benefits

Despite teacher retirement benefits being typically more generous than those of private-sector employees, research shows that teachers have inconsistent knowledge about their retirement benefits. A recent study of a nationally representative sample of teachers found that 45% could not identify what type of retirement plan they had, and that many teachers struggled to identify how much they are contributing to their plans, their retirement eligibility age, and the duration of their retirement benefits. Late-career teachers (20 or more years of experience) were much more adept at answering these questions, likely because they are closer to receiving retirement benefits. However, knowledge gaps of early- and mid-career teachers suggest that they may not know the extent to which retirement benefits disproportionately accrue to teachers who stay in the profession longer.

Perhaps unsurprising given teachers’ inconsistent knowledge of their retirement benefits, when asked how they prioritize salaries and pensions, a plurality of teachers indicated that they would prefer higher salaries at the cost of lower pensions. In 2018’s Voices from the Classroom survey, an annual, nationally representative survey of America’s teachers, 43% of teachers indicated that they would prefer a higher salary and a smaller pension, compared to 26% who would prefer a lower salary and a larger pension, with 31% unsure.

These survey data indicate an openness among teachers to a restructuring of their total compensation package. One possible reform is the introduction of a defined contribution retirement plan option. Under a defined contribution plan, all teachers could see a benefit from their investment, even if they stay in the profession for a short period of time. This option could also reduce the state’s pension liability.