Best Practices in Teacher Pay: Front-Loading Base Pay to Provide a Living Wage

A comprehensive, professional compensation plan includes layered pay strategies that build on one another to ensure the recruitment and retention of a high-quality workforce. This is the second in a series of blogs highlighting best practices in teacher pay featured in detail in BEST NC’s report, Teacher Pay in North Carolina: A Smart Investment in Student Achievement.

Front-Loading Base Pay to Provide a Living Wage

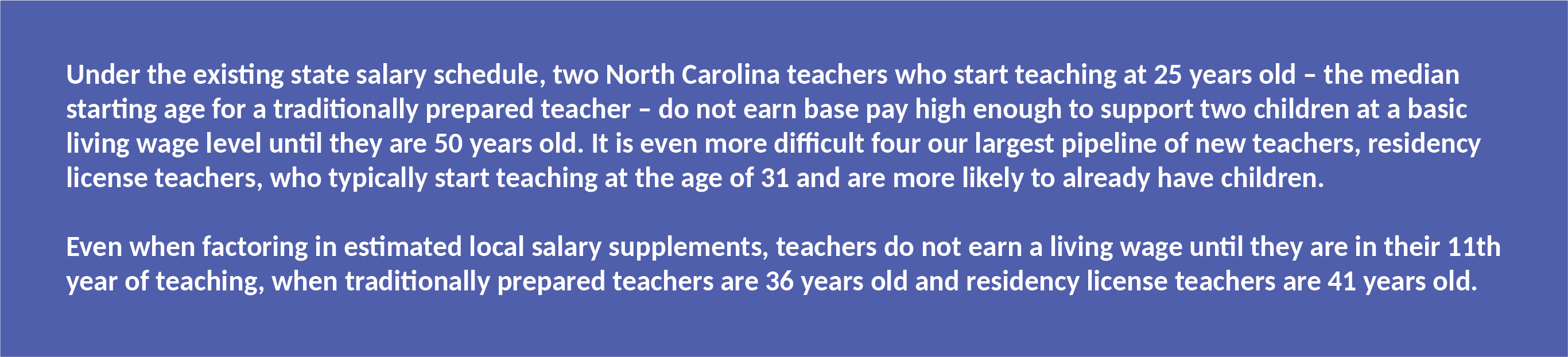

The first blog in our examination of Front-Loaded Base Pay explored how a front-loaded pay schedule better aligns with early-career surges in professional growth. In this blog, we discuss how a front-loaded pay schedule helps address biological pay motivators – the need to reasonably support oneself and one’s family.

While compensation levels are generally a function of market forces, it is reasonable that the minimum bar for high-skilled public employees should be at or above the living wage. With a substantial portion of North Carolina teachers currently paid below a living wage (approximately 20% of teachers, when including local supplements), this is an important call to action to front-load and modernize the state’s teacher salary schedule.

What is North Carolina’s Living Wage?

The Massachusetts Institute of Technology’s (MIT) Living Wage Calculator provides living wage data for North Carolina as a whole, as well as each county. A large affluent district like Wake County requires a higher living wage, for example, than rural counties like Halifax in the east or Caldwell to the west (see Exhibit 1 to the right). The living wage is calculated for a wide range of household circumstances, based on the number of adults, children, and working adults. For simplicity, we examine two scenarios: a single adult with no children and a two-parent household with two children, each with incomes about the same.

j

How the Step-and-Lane Schedule Stifles the Ability to Reach a Living Wage

While average teacher pay in North Carolina is at or above a living wage level, the structure of our pay schedule creates a significant gap between salaries and a living wage early in a teacher’s career, when they are reaching their full professional capacity, but still far from the peak of their earning potential.

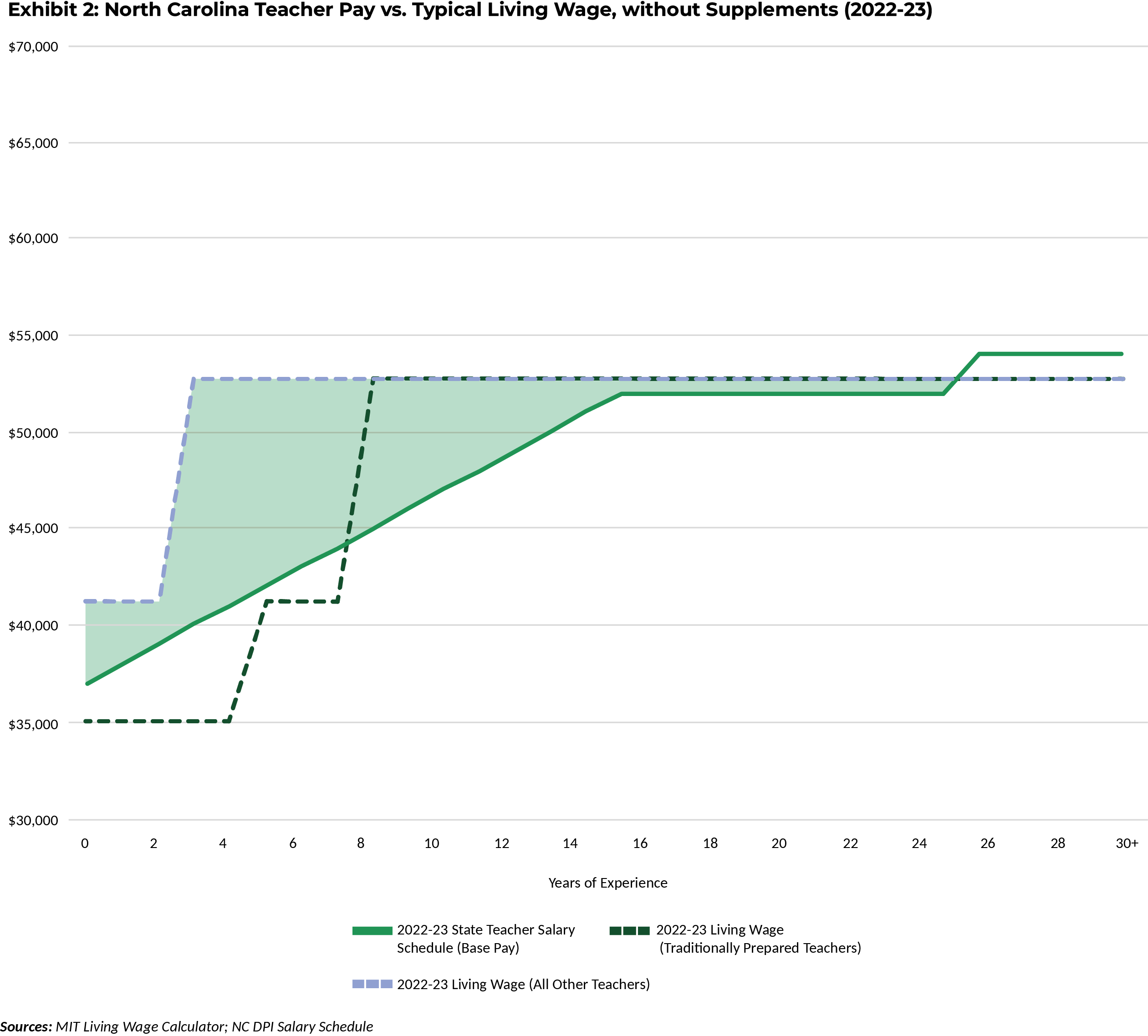

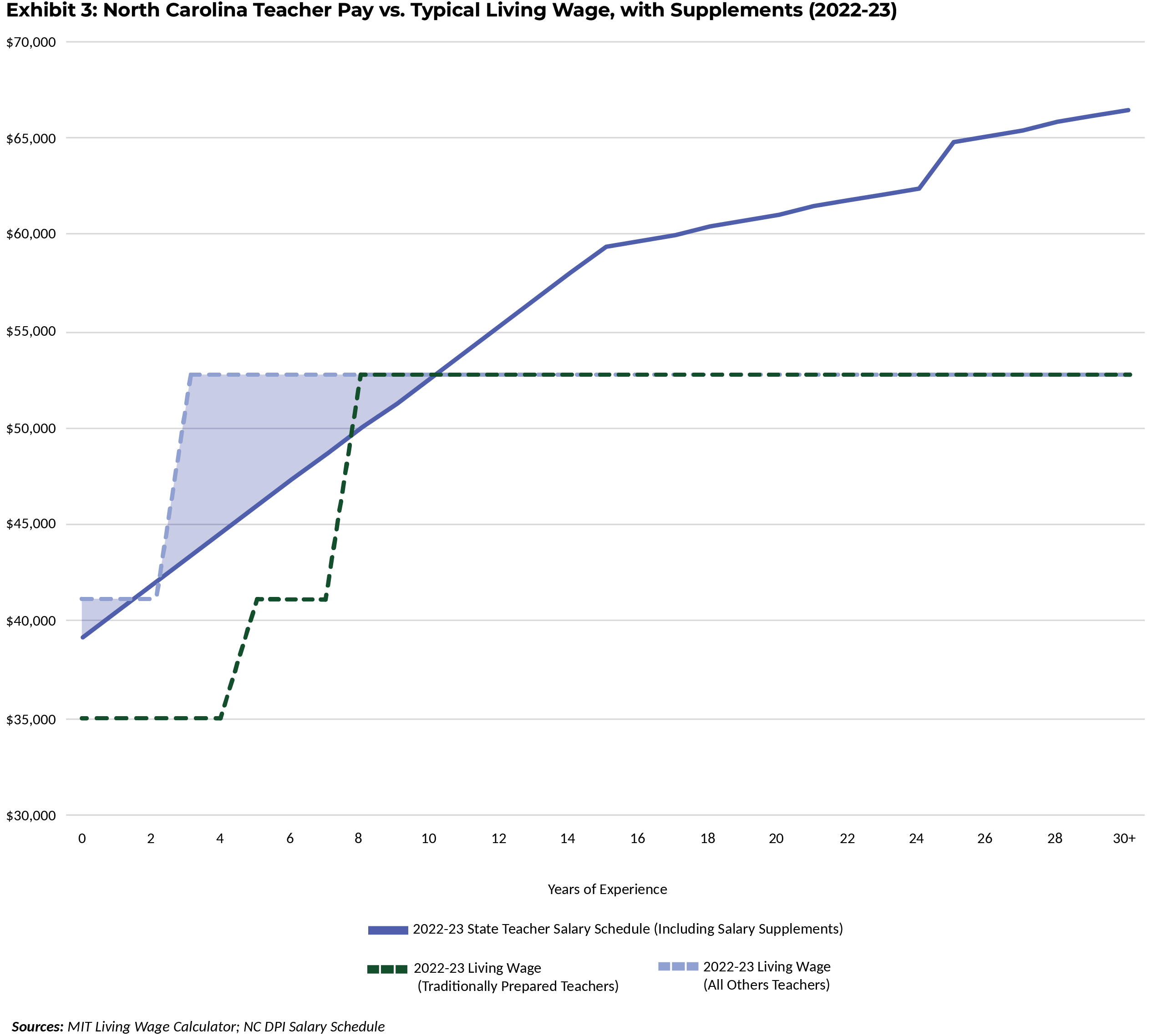

The charts below show the 2022-23 state teacher salary schedule overlaid with the living wage trajectory for a typical professional educator, with and without local salary supplements. In each chart, we have included the living wage trajectory for two different types of teachers – traditionally prepared, who start at age 25, on average, and all other teachers, who have a median starting age around 30 years old. In these charts, the gap between the current salary schedule and the living wage is shaded, clearly illustrating the inadequate income levels at the front of the salary schedule.

Exhibit 2 shows the state teacher salary schedule, or base pay schedule, without local supplements. When looking only at state pay, we estimate that, in any given year, nearly 65% of teachers earn less than a living wage.

j

j

When you include estimated local salary supplements (see Exhibit 3 below), an estimated 20% of all teachers earn less than a living wage each year.

j

j

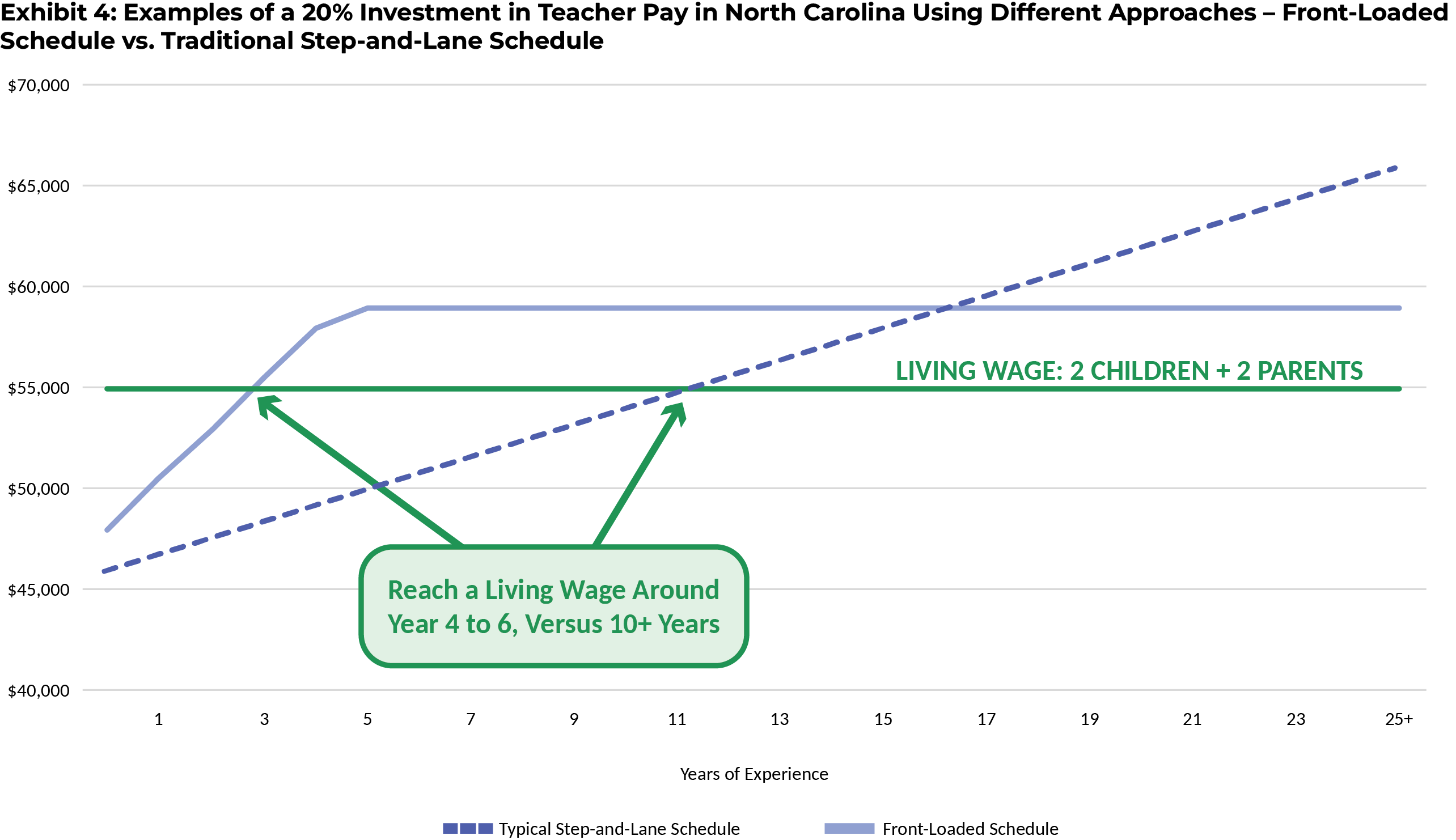

How Front-Loading the Salary Schedule Can Reduce the Living Wage Gap

The impact of front-loading the salary schedule on teachers’ ability to attain a living wage early in their careers comes into focus when considering a hypothetical investment to raise teacher pay in North Carolina by 20%. In one scenario, the 20% investment is made using a front-loaded salary schedule that aligns with most other professional industries, and in the other, the investment is spread out evenly across North Carolina’s step-and-lane salary schedule. Exhibit 4 below shows that, at the same level of investment, front-loading the teacher salary schedule allows a family with two working teachers and two children to reach a living wage more than twice as quickly than they would under the current step-and-lane salary schedule.

j

Note: This investment is projected to be made over a two-year period, so we have raised the living wage for a family of four (two incomes; two children) by 2% per year for the period of that two-year investment.